Building Wealth: Maximizing Real Estate Investments

Real estate has long been considered one of the most lucrative and stable investment options available. Whether you are a seasoned investor or just starting out, the potential for building wealth through real estate is undeniable. In this article, we will explore the various ways in which you can maximize your real estate investments and turn them into a strategic tool for financial success.

One of the key benefits of investing in real estate is the ability to generate passive income. Rental properties, for example, can provide a consistent stream of income each month, allowing you to build wealth over time. By carefully selecting properties in high-demand areas and managing them effectively, you can ensure a steady flow of rental income that will continue to grow as property values appreciate.

Another way to maximize your real estate investments is through strategic renovations and improvements. By upgrading your properties and increasing their value, you can command higher rents or sell for a profit. Whether it’s updating the kitchen and bathrooms, adding a fresh coat of paint, or landscaping the backyard, investing in your properties can pay off in the long run.

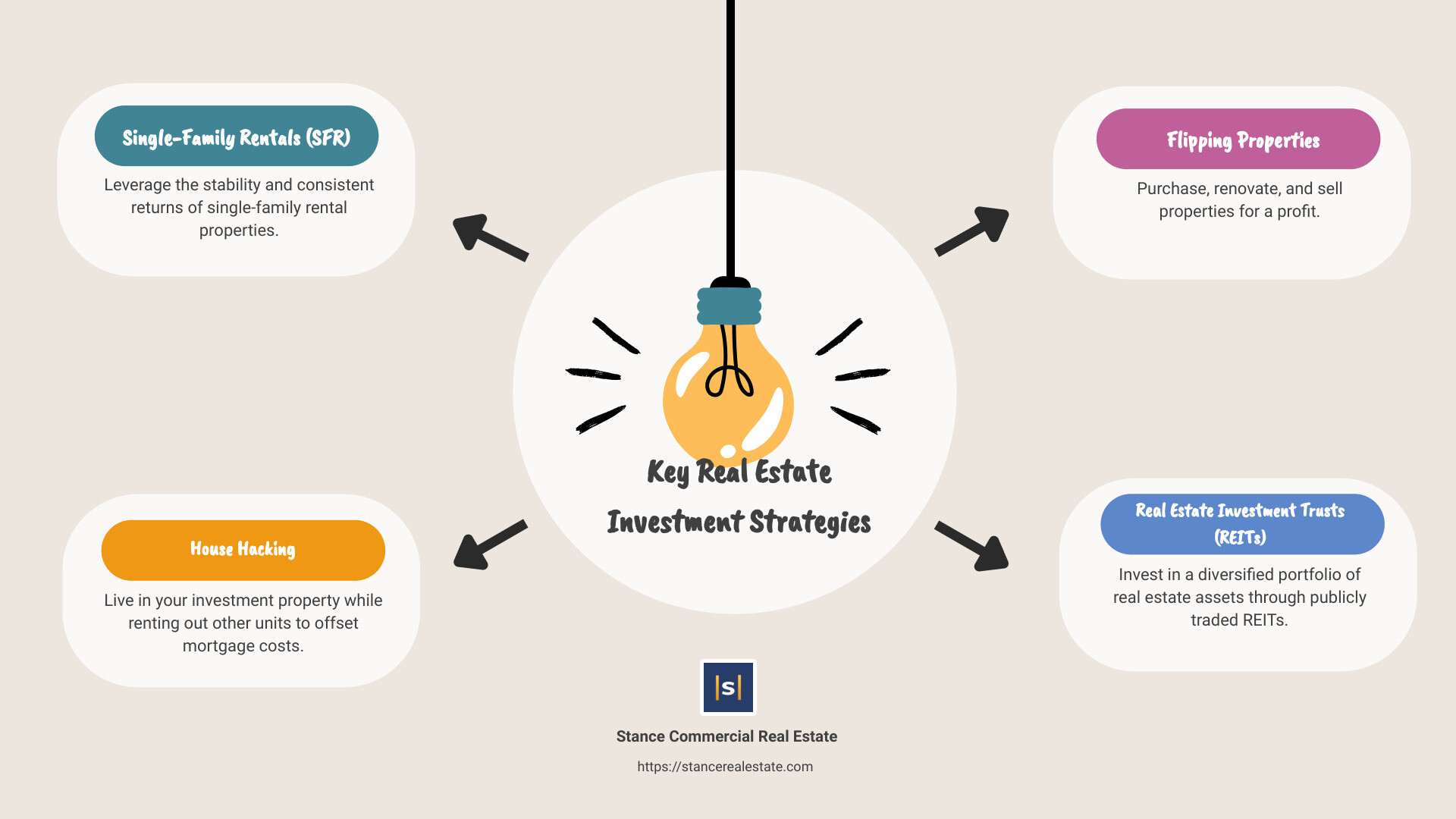

In addition to rental properties, there are other ways to build wealth through real estate. For example, flipping houses can be a lucrative venture if done correctly. By purchasing properties at a discounted price, making necessary repairs and upgrades, and selling for a profit, you can turn a quick return on your investment. While flipping houses can be risky, with the right knowledge and expertise, it can be a successful strategy for building wealth.

Image Source: bannerbear.com

Real estate also offers the benefit of leveraging other people’s money. By taking out a mortgage to finance a property, you can use a small amount of your own money to control a much larger asset. This allows you to maximize your returns while minimizing your risk. And as property values appreciate over time, your equity in the property will increase, further growing your wealth.

Furthermore, real estate can provide tax benefits that can help you maximize your investments. From deductions for mortgage interest and property taxes to depreciation allowances, there are a number of tax advantages to owning real estate. By taking advantage of these benefits, you can reduce your tax liability and increase your overall return on investment.

Finally, one of the most powerful ways to build wealth through real estate is through long-term appreciation. Historically, real estate values have tended to increase over time, making it a relatively safe and stable investment. By holding onto your properties for the long term, you can benefit from the appreciation of property values and build wealth slowly and steadily.

In conclusion, real estate is a powerful tool for building wealth and achieving financial success. By maximizing your investments through rental income, renovations, leveraging, tax benefits, and long-term appreciation, you can create a solid foundation for your financial future. Whether you are looking to generate passive income, flip properties for a quick profit, or simply build a diverse portfolio of assets, real estate can be a strategic and effective investment tool.

Unlocking Potential: Harnessing Property for Success

Real estate is often seen as a tangible asset that can provide a stable source of income and long-term growth. From residential properties to commercial buildings, the possibilities for leveraging real estate as a strategic investment tool are endless. When it comes to unlocking the full potential of property for success, there are several key strategies and tactics that investors can employ to maximize their returns and achieve their financial goals.

One of the most effective ways to harness property for success is through rental income. By investing in rental properties, investors can generate a steady stream of passive income that can help supplement their primary source of income or even replace it entirely. Rental properties can provide a reliable source of cash flow, especially in cities with high demand for housing or in popular vacation destinations. By carefully selecting the right properties and setting competitive rental rates, investors can unlock the full income potential of their real estate investments.

In addition to rental income, property appreciation is another crucial aspect of leveraging real estate for success. Over time, the value of properties tends to increase, especially in high-demand markets or areas experiencing rapid growth. By holding onto properties for the long term, investors can benefit from capital appreciation and build wealth through property appreciation. This can be particularly lucrative in markets with limited supply and high demand, where property values can skyrocket over a relatively short period.

Another way to unlock the potential of property for success is through strategic renovations and improvements. By investing in upgrades and renovations, investors can increase the value of their properties and attract higher-paying tenants or buyers. Whether it’s updating the kitchen, adding a fresh coat of paint, or improving the landscaping, small improvements can go a long way in enhancing the appeal and value of a property. By staying on top of maintenance and making smart investments in upgrades, investors can maximize the return on their real estate investments.

Furthermore, diversification is key to harnessing property for success. By investing in a diverse portfolio of properties across different markets and asset classes, investors can mitigate risk and maximize their potential returns. Diversification can help protect against market fluctuations and economic downturns, ensuring that investors can weather any storm and continue to grow their wealth over time. By spreading their investments across a range of properties, investors can unlock the full potential of real estate as a strategic investment tool.

Lastly, staying informed and educated about the real estate market is crucial for success. By keeping up with market trends, economic indicators, and local developments, investors can make informed decisions and capitalize on emerging opportunities. Whether it’s staying updated on rental market trends, monitoring property values, or networking with other industry professionals, staying informed can help investors stay ahead of the curve and maximize their returns. By continuously educating themselves and adapting to changing market conditions, investors can unlock the full potential of property for success.

In conclusion, real estate has the potential to be a powerful tool for building wealth and achieving financial success. By harnessing the income-generating potential of rental properties, capitalizing on property appreciation, making strategic renovations, diversifying their portfolios, and staying informed about market trends, investors can unlock the full potential of property for success. With the right mindset, strategies, and tactics, investors can leverage real estate to achieve their financial goals and build a successful investment portfolio.

How to Use Real Estate as Part of Your Investment Strategy