Harnessing the Power of Sustainable Investing

In today’s world, where environmental and social issues are at the forefront of global consciousness, sustainable investing has become a popular and effective strategy for investors looking to make a positive impact while also generating financial returns. Sustainable investing, also known as socially responsible investing or impact investing, involves selecting companies that are committed to environmental stewardship, social responsibility, and good governance practices.

One of the key advantages of sustainable investing is the potential for long-term outperformance. Companies that prioritize sustainability and ESG (environmental, social, and governance) factors tend to be more resilient and better equipped to navigate the challenges of a rapidly changing world. By considering these factors in their investment decisions, investors can identify companies with strong management teams, solid risk management practices, and a focus on innovation and long-term growth.

Another advantage of sustainable investing is the ability to align your investments with your values and beliefs. Many investors are increasingly looking to put their money into companies that are making a positive impact on society and the environment. By investing in sustainable companies, you can support initiatives such as renewable energy, clean technology, and social justice, while also potentially benefiting from their success in the market.

Sustainable investing also offers the potential for risk mitigation. Companies that neglect environmental and social factors are at greater risk of facing regulatory scrutiny, reputational damage, and financial liabilities. By investing in companies with strong sustainability practices, you can reduce your exposure to these risks and potentially enhance the overall risk-return profile of your portfolio.

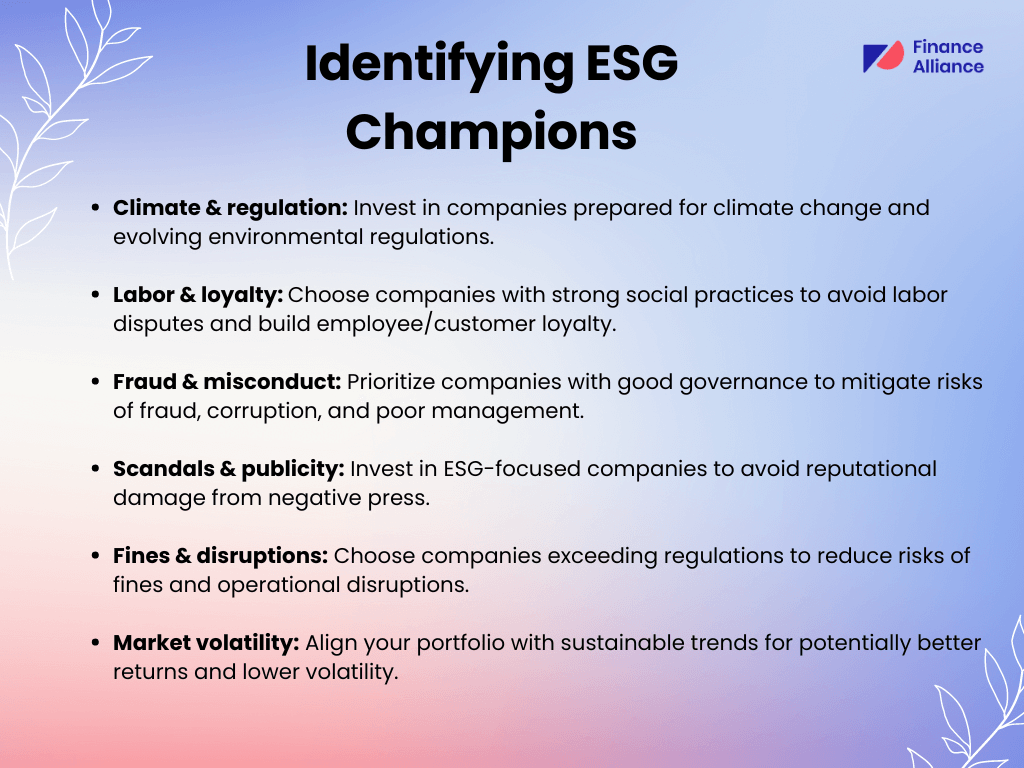

Image Source: financealliance.io

Furthermore, sustainable investing can lead to positive social and environmental outcomes. By directing capital towards companies that are committed to sustainability, investors can help drive positive change in areas such as climate change, human rights, and diversity and inclusion. This impact can extend beyond individual companies to influence industry standards and practices, creating a ripple effect that benefits society as a whole.

In addition to these benefits, sustainable investing can also enhance investor engagement and transparency. Companies that are committed to sustainability are often more transparent in their reporting and more responsive to stakeholder concerns. By engaging with these companies on sustainability issues, investors can help drive improvements in corporate behavior and performance, leading to better long-term outcomes for both investors and society.

Overall, sustainable investing offers a compelling combination of financial returns, social impact, and risk management benefits. By harnessing the power of sustainable investing, investors can not only align their portfolios with their values and beliefs but also contribute to a more sustainable and equitable future for all. So why not consider incorporating sustainable investing strategies into your investment approach and help make a positive difference in the world?

Uncovering the Benefits of ESG Strategies

In recent years, there has been a growing shift towards sustainable and ESG (Environmental, Social, and Governance) investing strategies. ESG investing focuses on investing in companies that adhere to principles of sustainability, social responsibility, and good governance practices. This approach has gained popularity among investors who are not only looking to make a positive impact on the world but also seeking financial returns. Let’s take a closer look at the benefits of incorporating ESG strategies into your investment portfolio.

One of the key advantages of ESG investing is the potential to generate long-term returns. Companies that prioritize sustainability and good governance tend to perform well over time. By investing in these companies, you are not only supporting businesses that are making a positive impact on the world but also positioning yourself to benefit from their long-term success. Research has shown that companies with strong ESG practices are more likely to outperform their peers in the long run, making them attractive investment opportunities.

Another benefit of ESG investing is risk mitigation. Companies that prioritize ESG factors are better equipped to manage risks related to environmental, social, and governance issues. By investing in these companies, you are reducing the risk of being exposed to controversies, lawsuits, or other negative events that could impact their performance. This can help protect your investment portfolio from potential downturns and volatility, making it a more stable and resilient investment option.

ESG investing also allows you to align your investments with your values and beliefs. Many investors are increasingly conscious of the impact their investments have on the world and are looking for ways to invest in line with their principles. By incorporating ESG strategies into your investment portfolio, you can ensure that your money is being used to support companies that are making a positive impact on society and the environment. This can provide a sense of fulfillment and satisfaction, knowing that your investments are contributing to a more sustainable and responsible future.

Furthermore, ESG investing can also improve corporate behavior. By investing in companies that prioritize ESG factors, you are sending a clear message to the business world that sustainable practices are important. This can incentivize companies to improve their ESG performance in order to attract investment. As more investors demand transparency and accountability from companies, there is a greater pressure for businesses to adopt sustainable practices and improve their overall impact on society and the environment.

In addition, ESG investing can lead to better relationships with stakeholders. Companies that prioritize sustainability and good governance are more likely to attract and retain customers, employees, and investors who share similar values. By investing in these companies, you are aligning yourself with businesses that are well-positioned to build strong relationships with their stakeholders. This can lead to increased trust, loyalty, and support from customers and employees, as well as greater confidence from investors in the company’s long-term prospects.

Overall, the benefits of ESG investing are clear. By incorporating ESG strategies into your investment portfolio, you can potentially generate long-term returns, mitigate risks, align your investments with your values, improve corporate behavior, and build better relationships with stakeholders. As the world continues to prioritize sustainability and social responsibility, ESG investing is becoming an increasingly important and attractive investment strategy for investors who are looking to make a positive impact on the world while also achieving financial success.

The Benefits of Sustainable and ESG Investing Strategies