Supercharge Your Investments with Tactical Asset Allocation

When it comes to maximizing returns on your investments, one strategy that you should definitely consider is tactical asset allocation. This powerful technique involves adjusting the allocation of your investment portfolio based on current market conditions and economic trends. By actively managing your assets in this way, you can potentially increase your returns and minimize risks.

One of the key benefits of tactical asset allocation is its flexibility. Unlike traditional buy-and-hold strategies, which require you to stick with a set allocation of assets for the long term, tactical asset allocation allows you to adapt to changing market conditions. This means that you can take advantage of opportunities as they arise and react quickly to any potential threats to your investments.

Another advantage of tactical asset allocation is its potential for higher returns. By actively managing your portfolio and adjusting your asset allocation based on market conditions, you can potentially outperform the market and achieve higher returns than you would with a passive investment strategy. This can be especially beneficial during times of market volatility or economic uncertainty.

Tactical asset allocation also allows you to diversify your investments more effectively. By spreading your assets across a range of different investment classes, sectors, and regions, you can reduce the overall risk in your portfolio and increase the likelihood of achieving positive returns. This can help to protect your investments from market downturns and economic shocks.

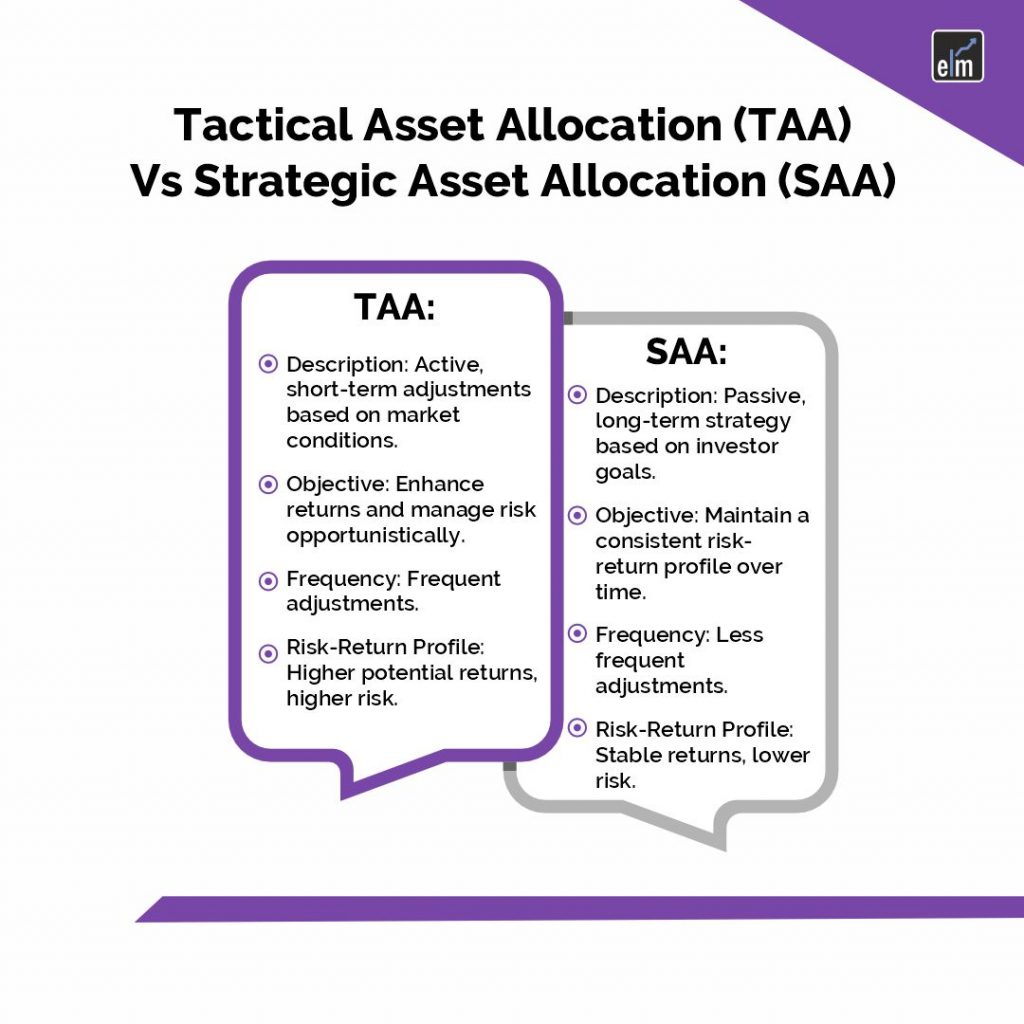

Image Source: elearnmarkets.com

In addition to these benefits, tactical asset allocation also offers the potential for enhanced risk management. By actively monitoring market conditions and adjusting your asset allocation accordingly, you can potentially minimize the impact of market volatility on your investments and reduce the overall risk in your portfolio. This can help to protect your capital and ensure that you are better positioned to achieve your financial goals.

Overall, tactical asset allocation is a powerful strategy that can help you to supercharge your investments and maximize your returns. By actively managing your portfolio, adapting to changing market conditions, and diversifying your investments effectively, you can potentially achieve higher returns, reduce risks, and enhance your overall investment performance. If you’re looking to take your investment strategy to the next level, tactical asset allocation could be the key to unlocking the full potential of your portfolio.

Unlock the Power of Dynamic Strategies for Maximum Returns

In the world of investing, one of the key strategies to maximizing returns is through tactical asset allocation. This approach involves actively adjusting your investment portfolio in response to changing market conditions, with the goal of achieving the best possible return for a given level of risk.

One of the most effective ways to implement tactical asset allocation is through dynamic strategies. These strategies involve actively monitoring and adjusting your investment mix based on a variety of factors, including market trends, economic indicators, and geopolitical events. By constantly reassessing and realigning your portfolio, you can take advantage of opportunities for growth and minimize the impact of market downturns.

One of the key benefits of dynamic strategies is their ability to adapt to changing market conditions. Unlike static investment strategies, which remain fixed regardless of market fluctuations, dynamic strategies allow you to respond quickly to new information and adjust your portfolio accordingly. This flexibility can help you take advantage of emerging trends and avoid potential losses.

Another benefit of dynamic strategies is their potential for higher returns. By actively managing your investments and reallocating assets as needed, you can position yourself to capture opportunities for growth and outperform the market. This proactive approach can lead to greater returns over time, helping you achieve your financial goals more quickly.

Dynamic strategies can also help you manage risk more effectively. By regularly reassessing your portfolio and adjusting your asset allocation, you can reduce your exposure to market volatility and minimize potential losses. This can provide a greater sense of security and peace of mind, knowing that your investments are being actively monitored and managed.

Furthermore, dynamic strategies can help you diversify your portfolio more effectively. By constantly evaluating the performance of different asset classes and making adjustments as needed, you can spread your risk across a range of investments and avoid overexposure to any one sector or asset. This diversification can help protect your portfolio from sudden market shifts and improve overall stability.

In addition, dynamic strategies can help you take advantage of short-term opportunities in the market. By closely monitoring market trends and economic indicators, you can identify potential areas for growth and reallocate your assets to capitalize on these opportunities. This proactive approach can help you maximize returns in the short term while still maintaining a long-term investment strategy.

Overall, unlocking the power of dynamic strategies for maximum returns can help you achieve your financial goals more effectively. By actively managing your investments, adapting to changing market conditions, and seizing opportunities for growth, you can position yourself for success in the ever-changing world of investing. So why not take advantage of the benefits of dynamic strategies and supercharge your portfolio today?

What Is Tactical Asset Allocation and How Can It Boost Your Returns?