Don’t Skip Your Financial Checkup!

As the year comes to a close, it’s important to take some time to reflect on your financial health and revisit your investment strategy. Just like going to the doctor for an annual checkup, your finances also need regular monitoring to ensure they are in good shape. Here are a few reasons why it’s crucial not to skip your financial checkup:

First and foremost, conducting a yearly financial checkup allows you to assess your current financial situation and track your progress towards your financial goals. By reviewing your income, expenses, assets, and liabilities, you can identify any areas that may need improvement and make necessary adjustments to stay on track.

Additionally, revisiting your investment strategy on a yearly basis can help you adapt to changing market conditions and economic trends. Markets are constantly evolving, and what may have worked for you in the past may no longer be the most effective approach. By staying up to date with the latest market developments, you can ensure that your investment portfolio remains well-balanced and diversified.

Another important reason not to skip your financial checkup is to identify any potential risks or areas of vulnerability in your financial plan. Life is unpredictable, and unexpected events such as job loss, illness, or market downturns can significantly impact your financial well-being. By conducting a thorough review of your finances, you can proactively address any potential risks and take steps to protect yourself against unforeseen circumstances.

Image Source: pacificlife.com

In addition to assessing your financial health, a yearly financial checkup also provides an opportunity to set new financial goals and priorities for the upcoming year. Whether you’re looking to save for a major purchase, pay off debt, or increase your retirement savings, taking the time to reassess your goals can help you stay motivated and focused on achieving financial success.

Furthermore, conducting a yearly financial checkup can help you stay organized and informed about your financial affairs. By gathering all of your financial documents in one place and reviewing them regularly, you can ensure that you have a clear understanding of your financial situation and can make informed decisions about your money.

Overall, don’t skip your financial checkup! Taking the time to review your finances on a yearly basis can help you stay on track towards your financial goals, adapt to changing market conditions, identify potential risks, set new priorities, and stay organized and informed. So, make it a priority to schedule your financial checkup each year and take control of your financial future. Your wallet will thank you!

Keep Your Investment Strategy Fresh!

As the saying goes, out with the old, in with the new. This phrase can be applied to many aspects of our lives, including our investment strategies. Just like how we spring clean our homes and declutter our closets, it’s equally important to revisit and refresh our investment portfolios on a regular basis. In this article, we will explore the importance of keeping your investment strategy fresh and why it’s crucial to regularly reassess and adjust your financial plan.

One of the main reasons why it’s essential to keep your investment strategy fresh is to adapt to changing market conditions. The financial market is constantly evolving, and what may have worked for you in the past may not necessarily yield the same results in the future. By revisiting and reassessing your investment strategy regularly, you can make adjustments to ensure that your portfolio remains aligned with your financial goals and objectives.

Additionally, keeping your investment strategy fresh allows you to take advantage of new opportunities that may arise in the market. As new investment products and strategies become available, staying proactive and open-minded can help you capitalize on these opportunities and potentially enhance your returns. By staying informed and constantly evaluating your portfolio, you can position yourself to make informed decisions that can benefit your overall financial well-being.

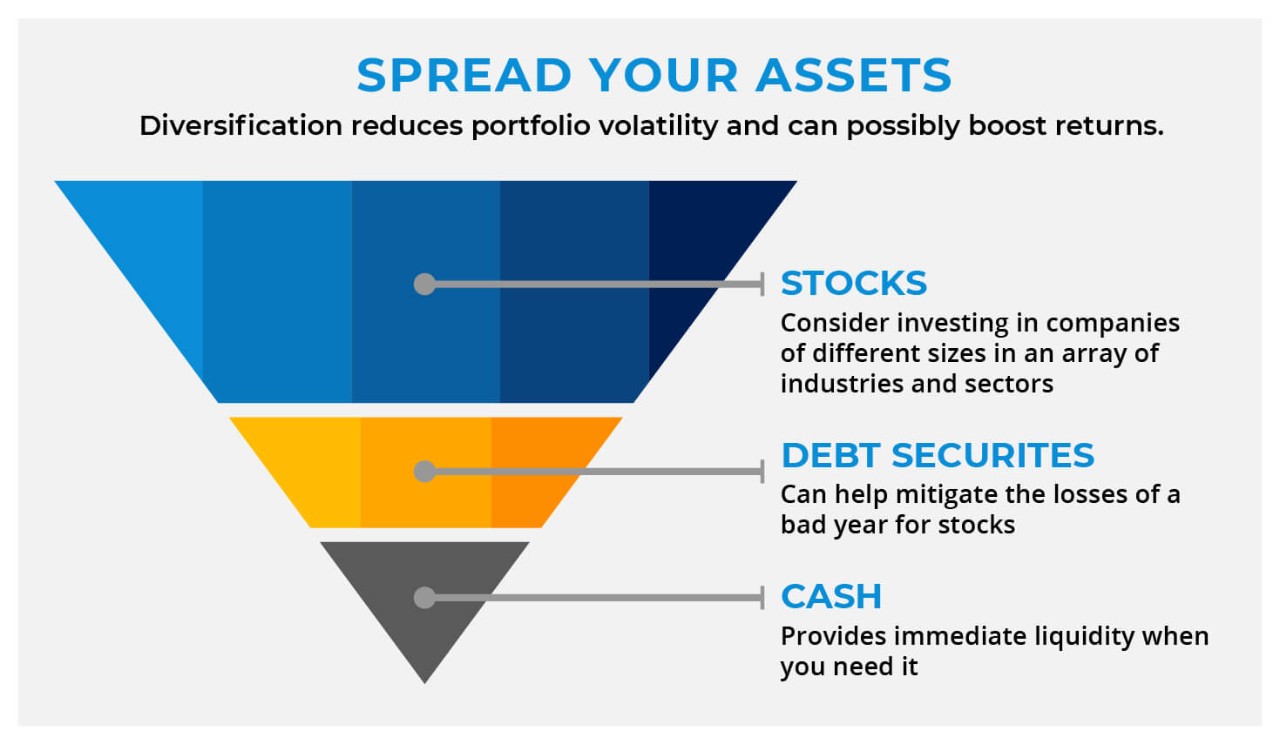

Another reason why it’s important to keep your investment strategy fresh is to mitigate risk. Diversification is key to a successful investment strategy, and by regularly reviewing and adjusting your portfolio, you can spread out your risk and protect your investments from market volatility. By diversifying your holdings and adjusting your allocations as needed, you can minimize the impact of market fluctuations and potentially reduce your overall risk exposure.

Furthermore, keeping your investment strategy fresh allows you to stay on track towards your financial goals. Life is unpredictable, and your financial goals and priorities may change over time. By regularly revisiting and reassessing your investment strategy, you can ensure that your portfolio is aligned with your current financial situation and objectives. Whether you’re saving for retirement, a major purchase, or your children’s education, adapting your investment strategy as needed can help you stay focused and on target towards achieving your goals.

In addition to adapting to changing market conditions, seizing new opportunities, mitigating risk, and staying on track towards your financial goals, keeping your investment strategy fresh can also provide you with a sense of empowerment and control over your financial future. By actively managing and monitoring your investments, you can take ownership of your financial well-being and make informed decisions that align with your values and priorities. This sense of control can help reduce anxiety and uncertainty about the future and give you confidence in your ability to navigate the complexities of the financial market.

In conclusion, keeping your investment strategy fresh is a vital component of a successful financial plan. By regularly revisiting and reassessing your portfolio, you can adapt to changing market conditions, seize new opportunities, mitigate risk, stay on track towards your financial goals, and empower yourself to take control of your financial future. So, don’t let your investment strategy gather dust – give it a refresh, and watch your portfolio flourish!

Why You Should Revisit Your Investment Strategy Every Year